Maximize Returns by Targeting High-Value Investments

Written on

Chapter 1: Understanding Value Investing in Technology

In his insightful book, Where the Money Is, Adam Seessel explores technology stocks through the lens of value investing. Having spent a significant portion of his career engaged in traditional "Cigar Butt" investing, Seessel recognized a shift in the 2010s, prompting him to focus on more robust, quality businesses.

Seessel begins by outlining the foundations of value investing as per Graham's principles, which he refers to as Value 1.0, emphasizing cheap asset companies. He then transitions to the Buffett method, which prioritizes cash flows (Value 2.0). Seessel argues that the evolution of technology necessitates a new framework—Value 3.0—due to the outdated nature of conventional accounting practices.

GAAP accounting serves well for companies with physical assets, but it struggles to accurately reflect the intangible assets inherent in technology firms. For instance, research and development (R&D) is classified as an immediate expense, while Seessel believes it should be depreciated over time, akin to tangible assets. This perspective aligns with the idea that if you purchase machinery with a lifespan of ten years, it makes sense to allocate the expense over its useful life rather than all at once. However, amortizing R&D is more complex due to the uncertainty surrounding its future benefits.

I contend that Buffett’s transition from focusing solely on assets to cash flows is more profound than what Seessel presents, suggesting a Value 2.1 evolution. In many respects, Buffett has also leaned towards valuing quality businesses, evident in his investment in Apple. Overall, Seessel's framework offers valuable insights for investors seeking to assess high-quality tech companies.

B.M.P. Framework

Seessel outlines a triad for evaluating a company's worth: Business Quality, Management Quality, and Price. The core concept revolves around investing in a strong business (B) led by capable management (M) at a reasonable price (P).

Business Quality

To determine if a business is "good," Seessel poses several key questions:

- Is the company's market share low?

- Is the market experiencing growth?

- Does the business possess a sustainable competitive advantage?

Affirmative answers to all three indicate a promising business with growth potential. The first two queries are particularly insightful, as they reveal the company's opportunity for expansion. The third question assesses whether the company can capitalize on its growth potential.

Management Quality

- Does management operate with an ownership mentality?

- Is management knowledgeable about what drives business value?

The fourth question is crucial; misalignment between management's interests and those of shareholders can lead to self-serving behavior. The fifth question, while relevant, is less of a concern for me. I prefer investing in companies so robust that they could be managed by a range of talent. This consideration becomes particularly valuable if one intends to hold the investment long-term.

Price

If you can affirm at least 4 out of 5 of the questions above, you may proceed to evaluate the price. Seessel recommends that the company's earnings yield should exceed 5% (P/E ratio < 20) as a critical consideration. If the price is too high, he suggests placing it on your watch list rather than making a purchase. He provides useful examples of projecting potential earnings for mature companies and considers various accounting techniques related to R&D and operating margins.

While I appreciate his focus on price, I question whether a P/E threshold is the best approach. Some companies may meet the initial criteria, yet a 20x P/E could signify overvaluation if growth is insufficient. A pricing strategy that incorporates growth expectations might be more suitable.

Application: Evaluating Google

Seessel walks through examples in his book, one of which is Google from 2015. Here, I will apply his checklist to assess Google’s current standing.

Business

Google's competitive advantages remain largely intact since 2015. Despite Microsoft's investments exceeding $10 billion in attempting to rival Bing, Google's position remains solid. In 2015, digital advertising constituted 25% of total ad spending, with Google accounting for 60% of this market. Although Google's share of digital ad spend has decreased to 28%, this still translates to 19% of total ad expenditure.

As digital advertising continues to capture a growing share of the overall advertising market, Google is poised for revenue growth, even if its market share may shrink.

Management

Since 2015, Google's management team has largely remained unchanged, and they have successfully maintained operating margins as revenue has increased. Additionally, the company has begun returning capital to shareholders through share buybacks.

Price

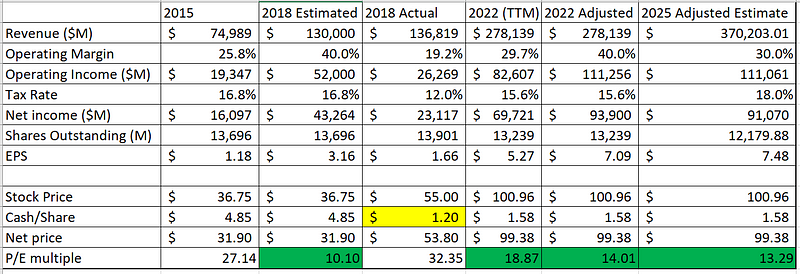

In 2015, Google's P/E ratio was reported at 28. Seessel adjusted the operating margin to 40% to align with Facebook and deducted Google's cash holdings from its market capitalization. He projected earnings growth at 20% for three years based on historical data, resulting in a P/E ratio of 10. Comparing this to 2018, the revenue growth was robust, although margins did not expand significantly, and cash per share decreased. Nevertheless, this analysis suggested a 15% annualized return.

Currently, Google's P/E stands at 18.7. By repeating the analysis with adjusted margins and cash deductions, the P/E drops to 14. I have also included a 2025 forecast with a 10% revenue growth projection and adjusted for a 30% margin, yielding similar results.

In the future, I aim to conduct a more in-depth analysis of Google as a business and spend additional time estimating its actual value. If you found this article engaging, please consider applauding it, and feel free to follow me on Medium or subscribe for notifications on future articles.