Smart Strategies to Outsmart Online Scammers with FinTech Tools

Written on

Chapter 1: Understanding the Tactics of Scammers

In my quest to avoid being deceived, I've stumbled upon a remarkably simple technique that has proven effective.

“We just want a little of your money!” Illustration by VectorGrove.

The phrase “fight fire with fire” might evoke mixed feelings, especially when it's one of my least favorite songs by Metallica. Yet, this idiom, originating from the mid-1800s, suggests using the same aggressive tactics as your opponent. While it often seems illogical to respond to aggression with similar measures, there are rare occasions where it might hold merit.

At its core, “fight fire with fire” refers to countering an aggressor's methods with equally extreme responses. This phrase traces its roots back to early firefighting practices in the U.S., where pioneers would set controlled fires to prevent larger wildfires from spreading by consuming the fuel ahead of them.

Sometimes, I find myself adopting this very strategy as a defense mechanism against the pervasive dark patterns employed by online services.

Section 1.1: What Are Dark Patterns?

According to Wikipedia, dark patterns are deceptive user interface designs that trick users into actions they didn't intend, like purchasing overpriced add-ons or signing up for subscription services. Some examples include:

- Roach Motel: Easy to sign up, but challenging to unsubscribe.

- Bait-and-Switch: Offering a free or heavily discounted service that’s either unavailable or limited, only to present pricier alternatives.

- Privacy Zuckering: Manipulating users into sharing more personal information than they planned.

- Misdirection: Obscuring necessary information or complicating language to mislead users.

Numerous articles and publications, such as UX Collective, delve deeply into dark patterns and their implications.

This video discusses the various scams and frauds prevalent in the fintech space, shedding light on dark patterns and how to combat them.

Section 1.2: The Ubiquity of Dark Patterns

Why do these deceptive practices continue to thrive? The academic discourse surrounding this phenomenon reveals that while dark patterns can yield short-term benefits for companies, they ultimately lead to customer dissatisfaction and potential legal issues.

Chapter 2: My Countermeasure Against Dark Patterns

Among the most notorious dark patterns is the “free trial” offer, where users must provide credit card details to access what appears to be a risk-free trial. While these offers may no longer be as ubiquitous, many consumers still find themselves drawn in, only to forget to cancel and incur unexpected charges.

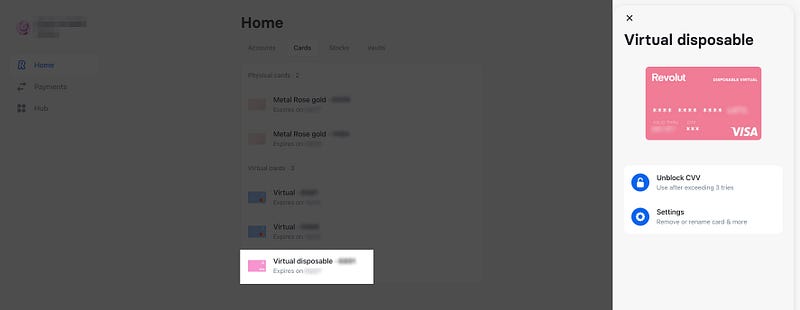

A game-changing solution I've discovered is the use of disposable virtual cards, which I primarily access through the British FinTech startup, Revolut. This service allows me to create a virtual card for each transaction, protecting my primary card details.

Creating a disposable virtual card is incredibly simple—it's a seamless process that requires minimal effort. I can sign up for premium services without the anxiety of forgetting to cancel, as these disposable cards automatically deactivate once they're no longer in use.

This approach has allowed me to navigate online subscriptions and offers without falling victim to the tactics employed by some SaaS companies. By leveraging disposable cards, I can take advantage of promotional trials without the risk of unintended charges down the line.

This video features Andrew Riabchuk, the founder of Akurateco, who explains the evolution of payment technologies, including the rise of virtual cards.

Section 2.1: A Smart Approach to Online Transactions

Not only do disposable virtual cards provide protection against unwanted charges, but they also offer flexibility for online shopping—especially on sites that lack secure payment options.

In conclusion, safeguarding your financial information online is crucial. By employing services that offer disposable virtual cards, you can shop and explore new subscriptions with peace of mind.

Remember: be cautious when sharing your credit card details, and always seek out secure alternatives that align with your needs!