Exploring the Rise of At-Home Ancestry Tests

Written on

Chapter 1: The DNA Test Boom

The genetic revolution has taken a significant leap forward, with consumer DNA testing becoming a mainstream phenomenon. In 2018, the volume of sales for at-home ancestry tests matched the total from all previous years combined, according to findings from MIT Technology Review.

The surge in interest surrounding ancestry and health, fueled by extensive advertising on television and the internet, has contributed to a record-breaking sales year for these tests. Consumers are enticed to provide saliva samples or cheek swabs, which are then sent to laboratories for genetic analysis.

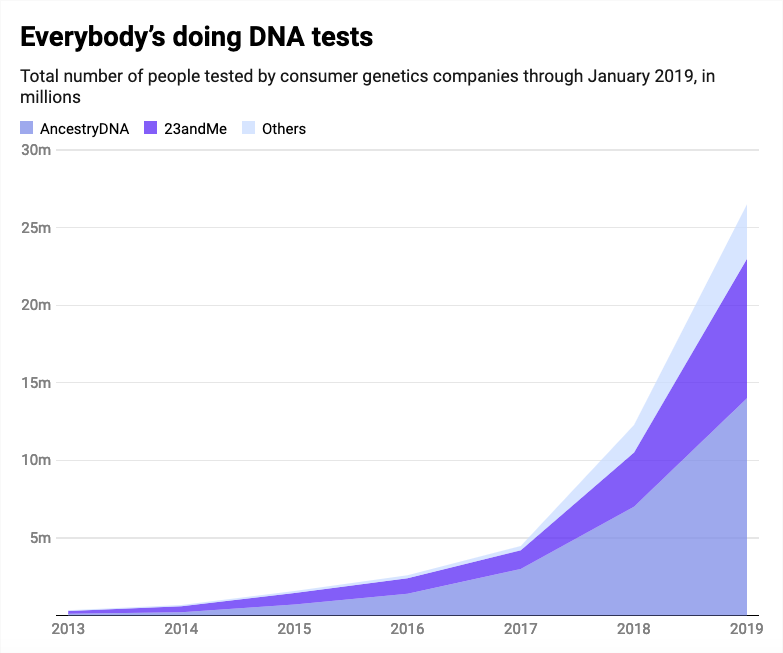

By early 2019, estimates indicated that over 26 million individuals had contributed their DNA to the leading commercial ancestry and health databases. If this trend persists, these databases could potentially contain genetic information for over 100 million people within just two years.

The Emergence of DNA Giants

This surge in testing has resulted in the rise of two dominant players in the market: Ancestry, based in Lehi, Utah, and 23andMe from Menlo Park, California. These privately-owned companies now boast the largest repositories of human DNA worldwide.

For consumers, these tests, which can be purchased for as little as $59, offer not only entertainment but also insights into family history and the possibility of uncovering hidden family connections. However, the implications for privacy extend far beyond individual curiosity. As these databases expand, they enable the tracing of familial relationships among a significant portion of the American population, including those who have never opted for testing.

What You Can Learn from DNA Testing

When you submit a sample, companies extract DNA from your cells and analyze it for approximately 600,000 genetic variations known as single-nucleotide polymorphisms. This analysis helps determine various aspects of your genetic background, including ancestral origins and potential family ties.

For instance, a notable case involved U.S. Senator Elizabeth Warren, whose DNA test confirmed her Native American ancestry, showcasing the distinct genetic signatures associated with different regions of the world, developed over millennia.

Individuals are often eager to compare their DNA with others; sharing large segments of identical DNA indicates a close relationship. Moreover, genetic testing can reveal specific traits, such as ear lobe shape or predisposition to certain health conditions. For example, 23andMe offers numerous trait reports, providing insights into genetic influences on everyday characteristics.

Chapter 2: The Competitive Landscape

The Expansion of Testing Companies

The number of individuals tested has been estimated based on statements from the four largest ancestry companies, alongside data from the International Society of Genetic Genealogy. As of late 2018, Ancestry reported a total of 14 million test kits sold, indicating a significant increase during the holiday season.

Gene By Gene, a company based in Houston, stated that its Family Tree DNA database comprises around 2 million profiles, although many are from earlier, less comprehensive tests. MyHeritage claims to hold about 2.5 million profiles. Meanwhile, 23andMe has reportedly tested over 9 million individuals, bringing the cumulative total of consumer tests to over 25 million.

It's essential to note that the data provided by these companies comes with important considerations. Not everyone who purchases a kit completes the test, and some individuals may test with multiple companies. Thus, the actual number of unique individuals tested is lower than the total number of kits sold.

Network Effects in the Market

Ancestry and 23andMe's vast size poses challenges for emerging competitors, as they benefit from a network effect. The more individuals that participate in these databases, the more valuable the information becomes for finding relatives and creating ancestry estimates.

MyHeritage, however, continues to grow, particularly in Europe, where it has localized its services into 42 languages. Even well-financed rivals face hurdles; for instance, gene powerhouse Illumina invested $100 million into Helix, a DNA testing "app store," but details on user purchases have been scarce, suggesting struggles in market penetration.

Health Implications of Genetic Testing

Among the four main companies, 23andMe distinguishes itself by offering health-related insights alongside ancestry information. Last year, it received FDA approval to test for specific breast cancer genes, offering consumers access to information that previously required a doctor's visit.

However, critics caution against relying on these tests due to their limited scope. The New York Times editorial board has advised consumers to approach such reports with skepticism, likening them to simple tricks rather than comprehensive evaluations.

Privacy and Crime Solving

One of the most significant implications of these databases emerged last May when California law enforcement used genetic information to identify the Golden State Killer, a criminal who had eluded capture for years. They accessed an informal ancestry database where users had shared their test results.

In response, the leading ancestry companies pledged to restrict police access to their databases without a warrant. However, Family Tree DNA quickly reversed this policy, allowing law enforcement to utilize its database for investigative purposes. This change, made without user notification, raises critical concerns about privacy and control over personal genetic data.

Elizabeth Joh, a law professor at UC Davis, poignantly noted the risks of relinquishing control over one's DNA, reminding consumers of the importance of being aware of how their data might be used under evolving terms of service agreements.

Antonio Regalado serves as the senior editor for biomedicine at MIT Technology Review, focusing on the intersection of technology, medicine, and biomedical research.